It’s safe to say that 2022 is turning out to offer a lot more opportunities in the micromobility industry. With government-backed transportation incentives set to multiply and new innovative vehicles coming to market in 2022, the groundwork is already being set for more energy-efficient, shared systems to hit the street. Which is why it’s important for you to lay your groundwork now when it comes to planning a go-to-market and/or growth strategy as a shared mobility business owner.

To make that process easier (and even more inspiring), here are five trends that will make 2022 the year to scale your operations—and how to start capitalizing on them today.

Numbers are pointing in the right direction

While 2021 has been marked by ups and downs for mobility operators worldwide, the industry as a whole is moving forward with more promise and momentum than ever. E-bike and traditional bicycle sales are soaring, and scooter operators in many regions are clocking more rides than they did pre-pandemic.

Earlier this year, the number of passenger-miles traveled by private and shared micromobility vehicles decreased by 65% in Europe and the U.S.; however, a recent McKinsey’s report points to a U-shape recovery, indicating that a return to pre-crisis levels will occur in 2022. According to McKinsey’s global consumer survey, the use of micromobility stands to actually increase—by 9% for private micromobility and by 12% for shared micromobility—compared to pre-pandemic levels. And there are hundreds of miles of new bike lanes being created in anticipation.

For example, Milan, Brussels, Seattle, Montreal, New York and San Francisco have each introduced more than 20 miles of dedicated cycle paths, and Paris is in the process of investing $325 million to update its bicycle network. The U.K. government also announced that all sales of diesel and petrol-fueled cars and vans will be banned after 2030 (moving up the original 2040 earmarked cutoff by a decade). Plus, about £582 million will be provided to help people afford zero- or ultra-low emission vehicles. More incentives mean more competition, and more opportunities for growth. There’s going to be a tangible need for more vehicles circulating to keep up with newfound micromoblity demand and infrastructure, especially in the untapped markets that giant mobility companies have avoided.

Scooters and bikes are in peak production (but get your orders in now)

If your fleet is already operating at capacity and you’re in need of more vehicles, or if you’re starting out with your initial hardware lineup, there’s good news: production of bikes, e-bikes and scooters is in stealth mode.

Lead times for scooters are averaging between one to three months, depending on the manufacturer, but our partners at ACTON and Segway are able to ship vehicles within a week if they have stateside inventory at their warehouses. Okai and Freego are also delivering swiftly. The more scooters you buy, the more likely the manufacturer will provide discount pricing.

Launch and scale logistics are getting easier

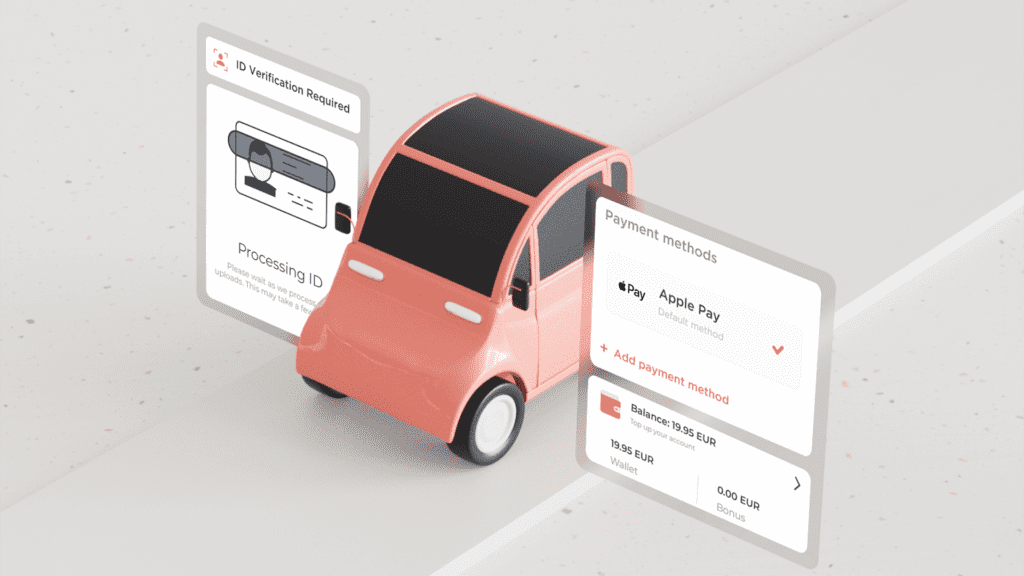

Depending on your business model (whether it’s B2B or B2C), logistics like permits, insurance and RFP applications may have stifled your growth plans in the past. As more mobility companies see the potential (and simplicity) of a B2B approach, you can expect to see a lot more businesses extending their existing fleets to hotels, residential complexes, corporate/college campuses and delivery services, which in turn eliminates the need for city permits and RFPs.

However, growing a fleet under a public B2C model is going to be smoother over the next number of months. Many regions have fast-tracked their tender periods in order to make micromobility more widespread, which is favorable to operators who are educated, compliant, well-managed and prepared to launch at the flick of a switch. If you’re looking to expand your fleet to Turkey, for example, preliminary research will show that the country only accepts operators with Segway vehicles.

For current Joyride operators and new ones, the RFP process is now easier through in-house expert proposal writing services and lobbying support, allowing you to edge out the competition with compliant applications that cities require. We’ve also been connecting our customers with the right (and most affordable) insurance providers based on their regions, which will continue to be a serious value-add to those looking to grow both in size and location in 2022.

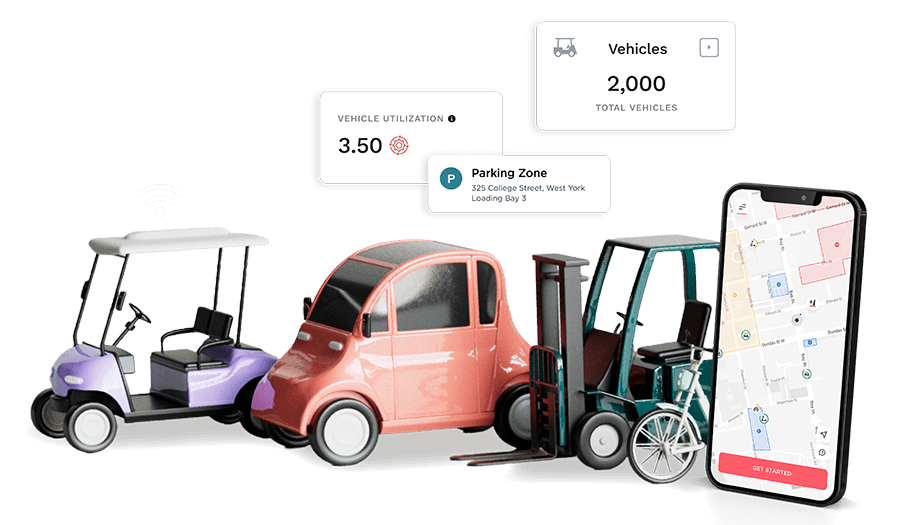

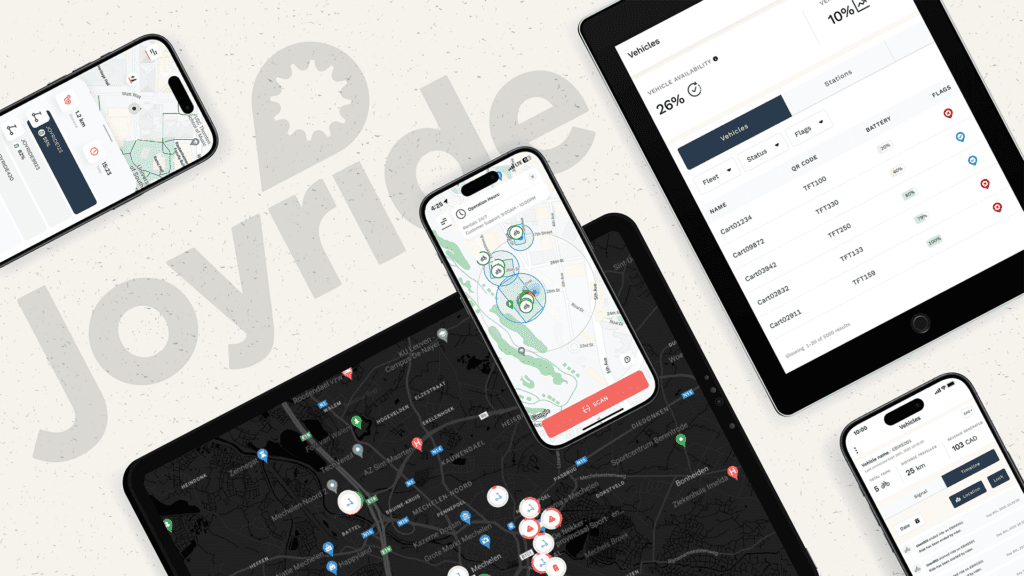

Software is getting better and better

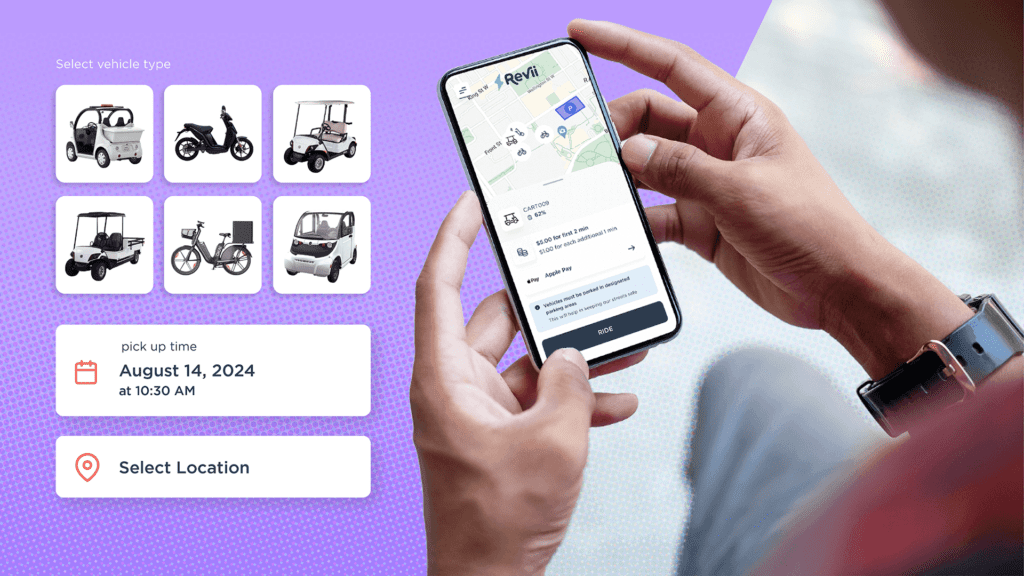

Growing your vehicle lineup is one thing, but you should also consider your expanding software needs. Do you operate through a docked, dockless or hybrid model? How do you plan to report your data feed to current and future municipalities? Are you adding new modalities to your fleet? What about offering long-term rentals?

These are the types of questions that need answering in response to the changing nature of the industry. More mixed modality fleets are coming in 2021, as many scooter operators look to add a fleet of e-bikes to their rental offerings, and traditional bike rental shops expand to include electric vehicles. There’s also going to be a rise in docking/charging stations that accommodate these mixed fleets, especially as the shift away from the dockless model continues into 2022.

We anticipate that once the infrastructure has further matured, docked and/or hybrid solutions will account for at least 50% of the shared micromobility market, which is expected to grow to $300 billion over the next decade. Joyride software has been designed to seamlessly toggle between supporting bikes, scooters and e-bikes in one place, and our lineup of charging hub integrations continues to grow quickly as this trend evolves.

In addition, as cities rely more and more on real-time location data analytics to improve their spatial intelligence and optimize redistribution and recharging efficiencies, they’re going to need compliant operators that provide advanced location-tracking technologies.

More hardware integrations are on the way

Scooters, bikes and e-bikes aren’t going anywhere, but more mopeds and cargo bikes are heading your way. As a hardware-agnostic software platform, pretty much any new IoT-enabled vehicle release has our attention. There will be a strengthened push towards using cargo bikes for deliveries in the year(s) ahead.

IKEA, for one, has committed to 100% zero-emission home deliveries by 2025 and has turned to cargo bikes to lead the charge now. In Spain and Germany, IKEA customers can now rent cargo bikes as sustainable delivery options, with more markets set to follow. Meanwhile, Chinese moped maker Niu Technologies is expanding its presence in Europe and the U.S. after demand for socially-distanced transport helped boost its shares by more than 400%.

Niu says growth in Europe and North America will be backed by breakthroughs in battery technology, policies supporting electrification and the ongoing rise of shared bike platforms. Since Joyride already integrates with mopeds like Niu, the ability to add these vehicles to your fleet can happen overnight—or at least in time for the new year.

Additional hardware advancements and/or fleet add-ons to consider are autonomous vehicles like Tortoise’s self-driving scooters and delivery vehicles, which struck a deal with Self Point for contactless, remote-controlled deliveries. More integrations like this can be expected to roll out over the next few weeks and months.

Make Joyride Part of Your 2022 Fleet Goals

Where to go from here? Right now is the opportune time to make 2022 the best year yet. To find out more about how Joyride’s platform can assist with your entire launch and growth plans, from RFP applications through to the App Store, contact us here today.