What a ride 2022 has been in the shared mobility ecosystem.

We’ve seen significant market expansions and contractions, tremendous vehicle innovation, major infrastructure developments, and tech advancements that improve fleet management. And, thankfully, we’ve seen a lot more of each other this past year, from events like the Joyride Academy Experience at Micromobility Europe, to interactive online workshops that bring the community together in the name of learning just how to get it all right.

What does the road ahead look like for shared mobility operators? For the mobility industry in general? For sustainable, cleantech companies? Read on to find out how we’re predicting things will play out over the next 12 months:

1. Going car-free is becoming more of a reality

The concept of cities isn’t going anywhere, but how we travel within them is continuing to transform. The upcoming year will usher in more changes than we’ve seen before. Cities currently host over half of the world’s population, a number expected to grow to nearly 70% by 2050.

More people shouldn’t equal more cars. There are tremendous health, financial and environmental benefits to eliminating-or at the very least reducing-gas guzzlers from the roads.

When Paris’ city center went car-free in 2015, levels of nitrogen dioxide dropped by up to 40% in parts of the city, and sound levels dropped by half in the city center. Meanwhile, studies from the City of Copenhagen show that the city loses $0.81 for every kilometer driven, but earns $0.74 for every kilometer cycled. When Madrid closed its city center to cars for the 2018 winter holiday season, retail earnings increased by 9.5% on the main shopping street.

It’s no surprise, then, that more than two-thirds of residents across London, Paris and New York are strongly in favor of reducing the number of cars in their cities. Giving more space to cyclists and pedestrians as an alternative is seen favorably by a majority in all three capitals (68%, 70% and 71% respectively). Copenhagen is also playing its part in leading the charge, take a look at how.

It’s also no surprise that in the US, e-bikes are now officially outselling electric cars and plug-in hybrids.

“Reprioritising space for people over cars will not only drive down pollution and emissions, it also means more space for communities to thrive, for businesses to draw in customers, and for pedestrians, cyclists and disabled people to travel through cities unimpeded,” Hirra Khan Adeogun, Head of Car Free Cities at climate charity Possible, recently told Zag Daily.

Removing cars from the equation means adding more lightweight electric vehicles and bicycles (and even more minimobility options, but we’ll get to that later!)

Expect to see more municipal dollars spent and government programs dedicated to growing renewable energy-powered public transportation options and more electric charging hubs for smaller vehicles. More bike lanes and scooter-sharing trials will continue to pop up in 2023 with much stronger mandates that go beyond fun and leisure. Also expect people to continue to choose micromobility for individual, long-term use. For example, private scooter ownership is up 42% in France, and ownership in other European markets, such as Germany, continues to climb significantly.

2. Smarter, greener scooters, bikes and batteries

While cities pave the way for more two-wheelers, what kind of improvements can we expect from vehicles this year? Micromobility hardware will continue to iterate in order to prolong lifespan and durability. This means:

- More efficient batteries with better energy density. Different materials will be brought to market, including lithium air, lithium sulfur, sodium ion batteries and graphene

- Smoother rides, thanks to more agile tires and advancements in motor design

- Increased cargo carrying capacity, so those cargo bikes can live up to their huge potential in sustainably transporting goods

- Solar vehicles are so 2023. Swedish retail giant Ikea, for one, has turned to solar-powered cargo bikes for deliveries. The Sunrider bike can accommodate around 90% of Ikea’s product range and emits 98% less CO2 than modern diesel vans.

- Onboard geofencing tech will be mainstream by the end of 2023

Beyond the hardware itself, more battery-swapping stations will start to appear from the likes of Yulu and Gogoro. Swobbee, meanwhile, is the first manufacturer-independent battery exchange station for all types of small electric vehicles, enabling batteries to be swapped in less than a minute. This level of self-service for fleet managers and delivery drivers will also trickle into self-checkout for different delivery form factors. The ability to rent delivery vehicles in dedicated microhubs will become more commonplace this year.

Additionally, more sustainably circular supply chains will emerge. This includes repairable batteries (take a look at Gouach), more battery recycling practices and a second life for vehicles (beginning with a second-hand market on Joyride Garage, more bike libraries and bike banks popping up around the world).

Expect to see more electric vans for rebalancing and e-cargo bikes for battery swapping. (Learn how to master the deployment of vehicles in our Joyride Academy rebalancing video series.)

Also be prepared to see more B-Corps emerge in the shared mobility space, joining the ranks with Beryl, Swapfiets and Human Forest. We’re also predicting solar-powered docking stations and scooter/bike share warehouses powered by renewable energy sources.

3. Minimobility will get a big push

From micro to mini? It is likely that “minimobility” will become increasingly popular in North America in 2023. As urban populations continue to grow, there will be a greater need for efficient and sustainable forms of transportation. Minicars, with their reduced size and efficient charging, are in a prime position to meet this demand.

After proliferating in China, India and some European markets, micro-vehicles are making way for the North American market. Micro-vehicles are the smallest size of car available with three or four wheels and they are powered by a smaller engine. Some are capped at 20 miles per hour, while some can hit up to 70 mph. With a price tag of a few thousand dollars or less–a tiny fraction of a new car–there is a growing demand for these miniature cars that fit one or two people and are designed for trips under 10 miles.

The micro electric vehicle market is projected to reach $22.11 billion in 2029, with a compound annual growth rate of 12.7% between 2022-2029. Last year, the industry was worth $8.32 billion.

In order to fully capitalize on the potential of minimobility, it will be necessary for Canadian and US policies to adapt and support the growth of this new form of transportation. This may include investments in charging infrastructure and changes to regulations governing the use of minicars on public roads.

As sustainable mobility expert David Zipper writes in Bloomberg, “The reduced size and efficient charging of minicars could address two of the most pressing transportation challenges in the US: reducing road deaths and cutting greenhouse gas emissions. Available in a motley assortment of shapes and sizes, these miniature mobility devices could help untether the United States from its destructive, expensive and entrenched addiction to automobiles.”

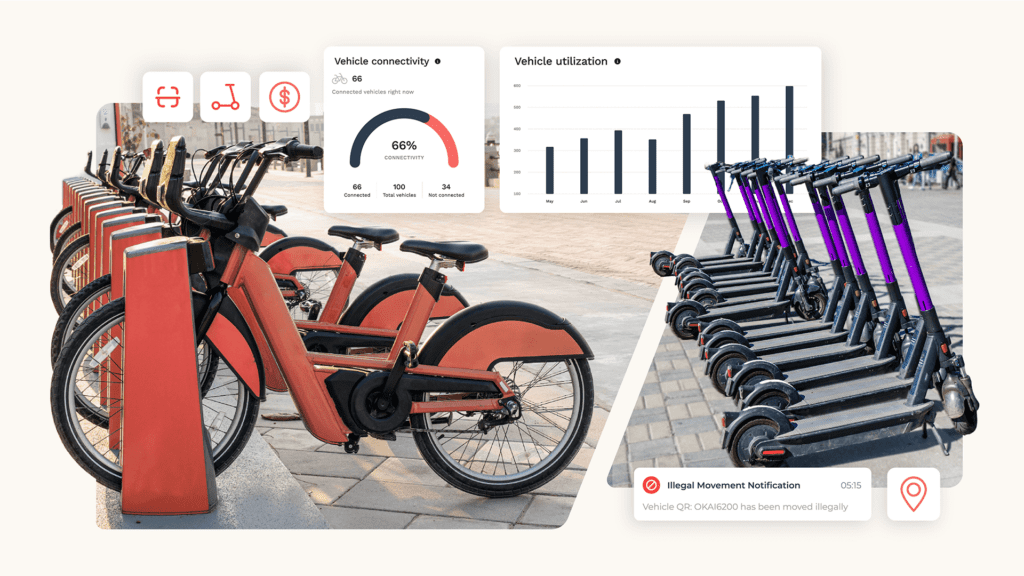

4. Mobility systems will rely more on automation

It’s safe to say that automation should automatically appear on every 2023 predictions list. The explosion of ChatGPT over the past few weeks is proving just how quickly industries can be reshaped by instant automated customer interaction and AI-powered services. College essay-writing may never look the same! Neither will the mobility world.

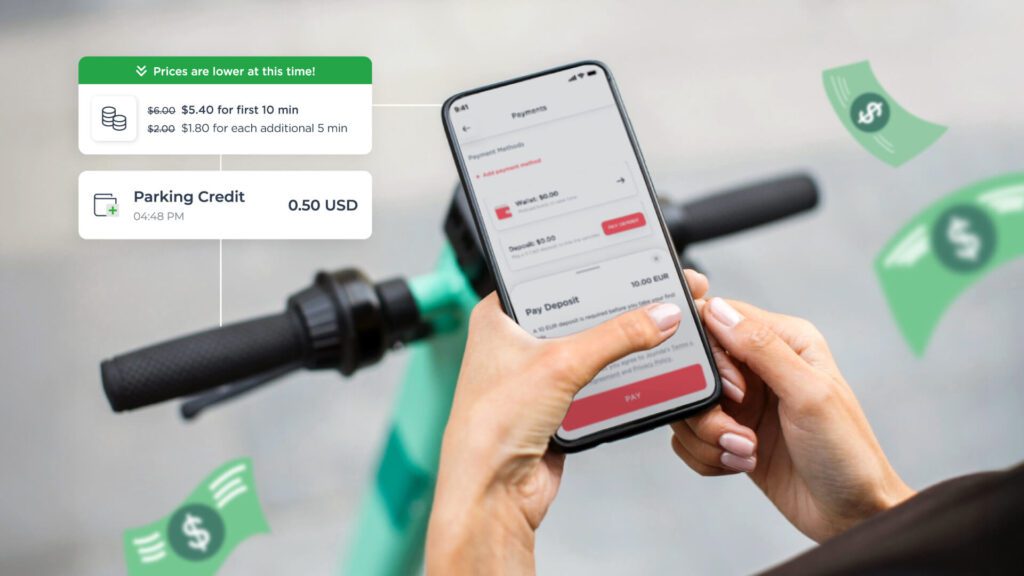

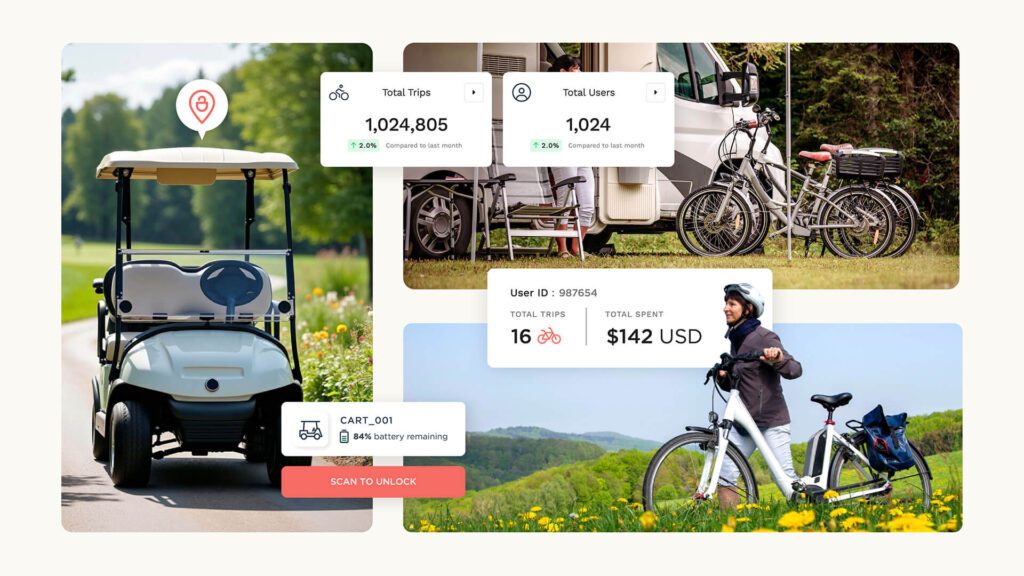

Customers of shared mobility systems expect more from their rental experience, from instant communication to diverse, seamless payment options. Browsing through Joyride’s App Plugins page offers a glimpse into the kind of features riders should have at their fingertips, including instant ID verification tools that authorize driver’s licenses and other documentation; Safe Ride DUI gamification tool that gauges a rider’s ability to operate electric vehicles; multiple payment methods that go beyond the standard credit card option; and Rider Etiquette information on how to ride properly.

From a fleet manager’s perspective, automation is the key to maintaining operations, from pre-setting rental hours to reacting to customer issues within seconds. For the latter, that’s where companies like Mavenoid will continue to build prominence in 2023. Direct, instant customer support not only strengthens brand loyalty, it is what will set your fleet apart from the competition.

Automated support, asset management, tracking and payment processing are also all going to make an antiquated delivery market much more streamlined.

5. Consolidation and creativity across sectors

Moving into 2023, expect continued industry consolidation, as (loudly and publicly) pointed out by Bird and Helbiz, and shown by Tier acquiring Spin, Lyft acquiring PBSC, and so on. Just this week, Bird Global announced its merger with Bird Canada, in a deal that represents an estimated $32 million in fresh financing.

The major surviving multinational micromobility sharing companies will continue to pair up. Some will be buying off the scrap heap of the companies that run out of money, others will be focused on market acquisition of mid-sized players, and some will be looking to diversify their modal portfolio and/or service offering.

For example, a micromobility giant may want to expand into the delivery space, so it will acquire an existing cargo e-bike company or a supplier like Zoomo in order to hit the ground running.

Enabling customers to manage journeys via train, bus, taxi, rental car and micromobility on a single platform, MaaS apps represent a major land grab subsector of the industry that will continue to gain momentum over the next few years, before consolidation occurs. For now, creative mobility tech will continue to streamline segmented markets.

Grab, which began life as a taxi-booking app, now describes itself as ‘Southeast Asia’s leading superapp.’ Its services include mobility, deliveries and banking. Indonesia-based Gojek started as a service for booking motorbike taxis (‘ojeks’) and now allows users to deliver medicines, pay electricity bills and even book massages. Another example is China-based DiDi, which has expanded from taxi booking to encompass food delivery and financial services.

Consolidation doesn’t necessarily mean companies buying each other, it comes in forms of consolidating services to make it as simple, sustainable and sophisticated as possible to promote usage of lightweight electric vehicles and public transport.

Lasting (or new?) impressions

As a relatively nascent industry, shared mobility is still growing globally in many different forms. Our own mission is to bring sustainable mobility systems to more than 10,000 cities, and 2023 will bring us–and you–one year closer to making this a reality the world over. Ready to learn more now? Contact us here.