Nearly one year after going public, micromobility operator Bird announced this month that it is pulling its scooters from small- to mid-sized US markets in order to reach more financial self-sustainability.

Plus, the company will also fully exit Germany, Sweden and Norway, as well as some other markets across Europe, the Middle East and Africa. Time to panic? Not exactly.

Being one of the biggest players in micromobility can come with drawbacks. At Joyride, we’ve long upheld the notion that independent, locally owned micromobility businesses are best positioned to capture billion-dollar opportunities in markets of varying sizes.

According to ABI Research, shared micromobility companies can unleash the potential of a market worth US$9 billion in ride revenues in 2030. This doesn’t even include the additional revenue opportunities that come along with running a shared mobility fleet.

Lean operations and slower burn rates bode well for our global roster of operators, and today we’re here to tell you all the reasons why the market is ripe as ever with micromobility opportunities:

1. Opportunities for the operationally-focused

Many billion-dollar micromobility companies lose sight of how important it is to control their own day-to-day, on-the-ground operations. Oftentimes, venture dollars are poured into million-dollar marketing budgets and product design programs, without paying the same level of attention to amplifying operations teams.

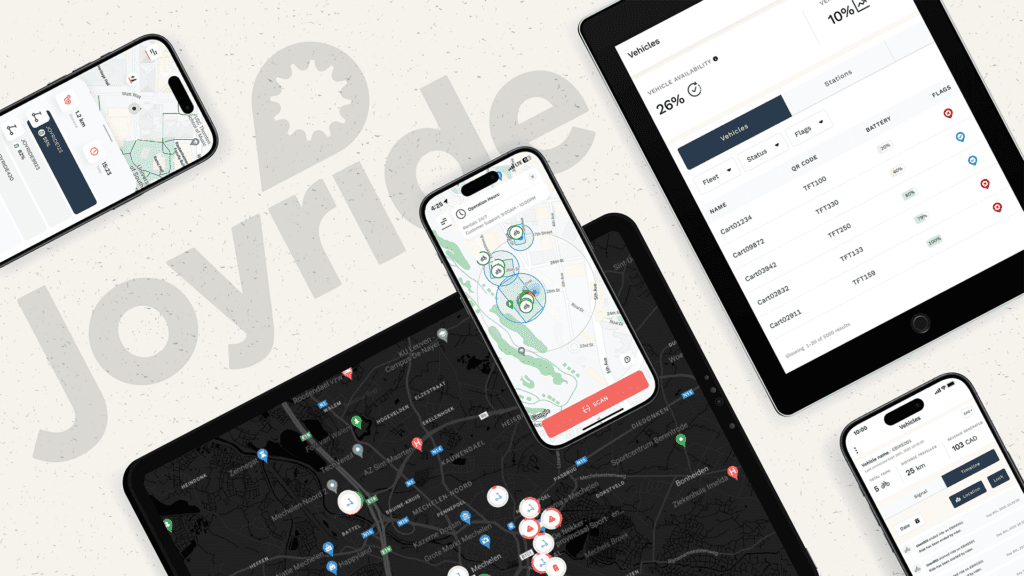

So what makes for an operationally excellent shared mobility service? We recently covered the ABCs of fleet profitability: Automated software features, Budgeting appropriately and Communicating with riders and staff through in-app/backend support tools.

The most operationally sound and forward-thinking operators are the ones who are obsessed with managing their burn rates and who understand fluctuating factors like seasonality, vehicle replacement costs, paying for rebalancing vehicles and the varying costs associated with global expansion.

Based on feedback collected by a number of Joyride operators, a huge amount of OPEX is saved by bringing fleet operations in-house as compared to contracting them out to a third-party service. Reasons include: staff buy into the business culture and success more and therefore perform better, they face less staff/contractor turnover and overall have more control on the fleet team they hire.

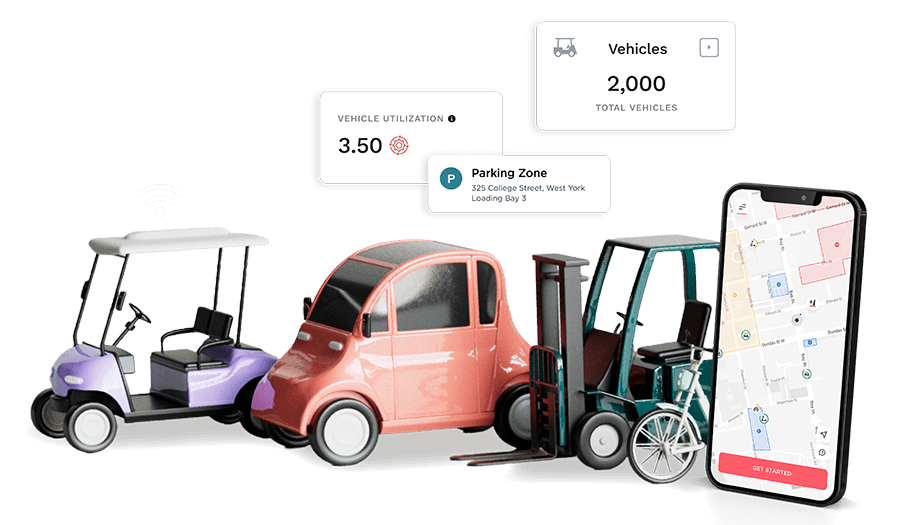

While we always focus on the big picture and want our operators to scale to new markets and modalities, operators with 2,000 scooters vs. 20,000 scooters will always have less overhead and are more inclined to focus more capital on the operational side of the business, which is going to have the biggest impact.

Even better, operators that use a platform like Joyride don’t have to pay software engineers, typically saving 90% of software fees when compared to building and running things in-house.

2. There’s a void in Europe with your name on it

A lot of complaints have been levied against the “regulatory framework” in Germany as a reason why large, venture-backed companies like Bird can’t succeed in this region. That’s not entirely the case.

Yes, the German government has more rules and regulations than other governments, but none of them are diminishing demand. Rather, they are just assurances that safety in both vehicle hardware and operational practice are adhered to for public good.

The former reason is a key thing to note. For a kick scooter to operate in a shared fashion in Germany, it must go through a special certification process to deem it worthy of road use by the general public. This certification currently limits the specific manufacturers and models of scooters available to deploy.

Until now, regulatory hurdles in Germany have been favoring large operators because they required special dedicated hardware for the German market. Due to that, operators have to place custom orders at the factories, which have very high minimum-order-quantities of 500+vehicles/3+ containers.

Smaller, local operators couldn’t reach that MOQ, and their only option was to get their vehicles and software from Bird. Now that Bird is exiting the region, a big void has opened, with less competition due to the regulatory hurdles.

Joyride has the German vehicles and software in place to help local operators fill that market gap and operate with the comfort of having fewer competitors. Find out more here.

Secondly, when an established company exits several markets, it is still leaving behind a wealth of demand for shared mobility experiences. The interest has far from flown the coop.

According to a new survey by digital association Bitkom, 96% of Germans have fundamentally changed their mobility behavior in recent years, due to rising energy prices, the global pandemic, rising public transportation prices and the climate crisis. The survey found that 39% of Germans use their bikes more often, while e-scooter and moped sharing have risen in popularity by 14%.

Meanwhile, in Ireland, a new Irish Finance Bill will provide a tax incentive of up to €3,000 to families who are interested in buying a cargo bike for transport and business trips, rather than a car or van.

Thanks to the big brands throwing money around to see what sticks, people are now more aware of e-scooters, e-bikes and cargo bikes as viable transportation options. That’s the advantage of being a second follower in this space.

Lots of people have tried micromobility for the first time and enjoyed riding LEV devices. Students, people without a car and tourists are now put-out that this transportation option is no longer available to them.

If a small operator can step in to address that gap, it could be profitable very quickly. There is evidence that oftentimes being the local operator can also be highly beneficial. Read concrete examples here.

3. Make noise with a private sharing model

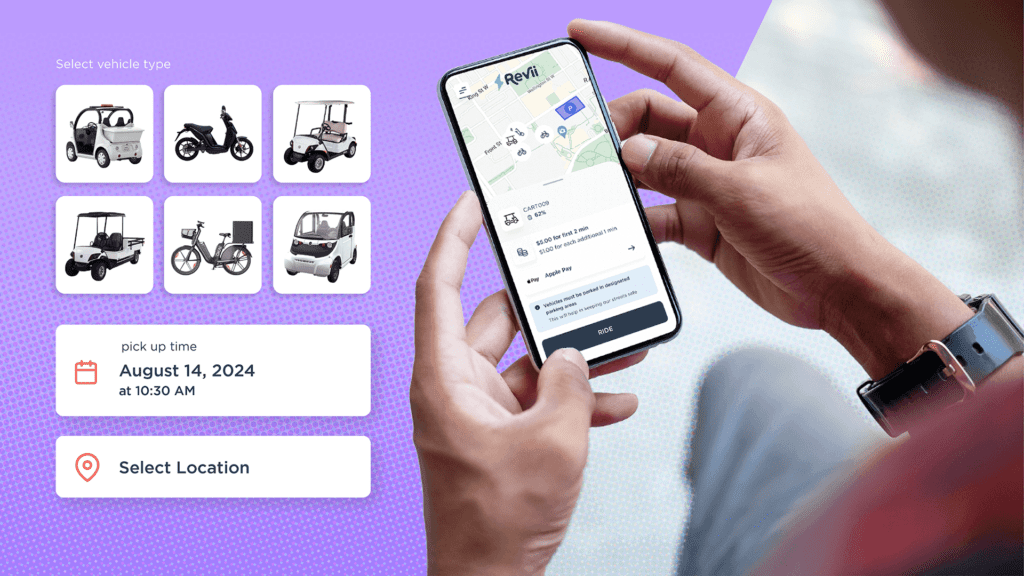

If any form of government regulation isn’t your cup of tea, operating a micromobility business under a private sharing model is a terrific way to circumnavigate municipal hurdles. Opportunities to lease e-scooters, bikes and mopeds to established businesses and institutions like hotels, college campuses and residential complexes are endless right now.

There are no shortages of university students looking to travel through campus on an electrified small vehicle, nor does this type of travel come with red tape processes involving city permits.

Private sharing models do require a lot of research and time investment to find a sustainable, mutually beneficial partnership. That’s only really possible if you understand the market at a local level.

Many Joyride-powered companies have private operations as lifestyle businesses, meaning they have different expectations and returns than venture-backed operations (many of which are looking for 10x returns or it won’t be worthwhile).

Leasing vehicles to hotels can be a headache-free source of additional revenue for entrepreneurs, who often don’t realize that they can make more than US$160,000/year just by running a private operation entirely on a software platform like Joyride.

4. More reasons to embrace energy-efficient transportation right now

Unfortunately, due to a number of conflating circumstances, the global energy crisis shows no signs of abating. Even with raised energy prices, the expected electric equivalent to petrol and diesel automobiles per kilometer is more favorable. Consumers on a budget will seriously consider shared electric mobility as a primary means of transportation as long as elemental weather permits.

People are also increasingly turning to electric vehicle subscriptions and leasing, which is used for more essential and regular trips that have a higher tendency to replace car trips (especially when it comes to commuting). For those in the delivery space, a solution such as Joyride Delivery gives you the right software and hardware to tap that demand through automated tools.

Thanks to Bird being at the forefront, pushing the industry forward as a whole, the vehicles built for sharing can now actually stand up to the literal winter. For example, the Aike sharing scooter (available on Joyride Garage), extends the potential operating season for colder climates. It can ride in the snow and has a lower center of gravity, to name a few.

Understanding the importance of unit economics and using efficient processes such as best battery recycling practices and rebalancing techniques in turn make the micromobility industry as energy-efficient as possible, which opens up opportunities for collaboration with city municipalities and infrastructure development.

There are billions of dollars up for grabs through energy-focused grants worldwide, and now’s the time to embrace a business model that benefits the planet as much as it does your bottom line.

Interested in more reasons to love LEVs and shared mobility right now? Reach out to us today here, and learn everything there is to know about operating a profitable fleet by checking out Joyride Academy here.