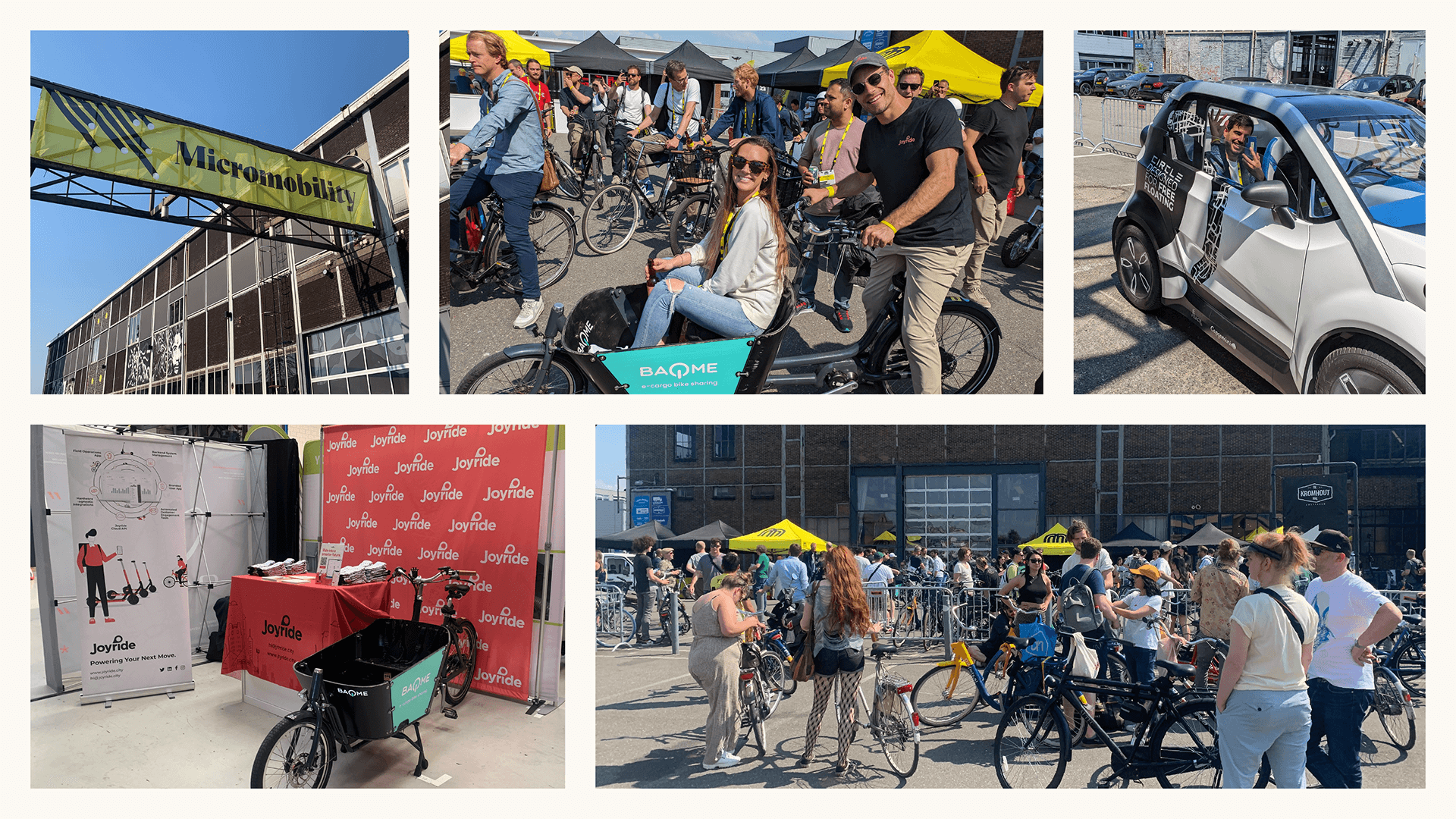

Last week, the Joyride team was proud to sponsor and attend the annual Micromobility Europe conference in Amsterdam. For two action-packed days, the global shared mobility industry gathered to celebrate, discuss and shape the largest trends in small electric vehicles – and we’re here to keep the conversation going.

From minicars to big conversations around sustainability, here are the three biggest takeaways that are shaping shared mobility right now:

1. Vehicle expansion–but also refinement

What’s a micromobility conference without plenty of micromobility vehicles? From the test track to the show floor, there was a wide variety of new and traditional lightweight electric offerings on display. Yet the overall takeaway is that there’s a large consolidation of modalities occurring, with product refinement on display.

Beyond the array of electric scooters and bikes, we saw more mopeds on the scene compared to prior years – with NIU, for one, having a standout presence. There was also a big welcome to minicars. Not surprisingly, the introduction of minicars to Micromobility Europe speaks to the trend of low-speed vehicles (LSVs) becoming more integrated for shared use. Street-legal minicars like GEM, Circle (designed specifically for sharing only) and Microlino are quickly making their marks in the shared mobility industry as operators see huge potential in adding more modalities to their fleets.

A large focus this year was also on batteries – not just for performance purposes but also as part of the B2C and B2B user experience. In fact, this was most visible for mopeds and minicar models, but in the scooter world there was a lot of talk around the need for increased battery safety and proper end-of-life disposal/upcycling.

Docking station offerings seem to be diversifying, meanwhile, with more affordable solutions for operators. There was a renewed focus on docking and charging solutions that are configurable to their local markets, with notable mentions including Knot, YUP and Mosa.

Also getting its fair share of mention during the conference was the e-cargo bike. Not surprisingly, there was plenty of panel content promoting the mode of e-cargo for sharing, delivery/last mile, subscription and owned. Companies like Joyride-powered Baqme, which joined us at the show last week, continue to expand to meet the market demand for this vehicle form.

Also diversifying is the number of scooter OEMs. While the big players like Segway and Acton still cover a significant chunk of the industry, don’t be surprised if you start hearing more about smaller manufacturers like Navee and Kuickwheel, both of which had sponsored booths at this year’s conference.

For a list of top industry vehicles available to purchase right now, visit Joyride Garage here.

2. Increased industry integrations

We like to talk a lot about industry consolidation, but we can’t help but notice much more collaboration occurring in micromobility right now. Yes, Bolt’s potential acquisition of Berlin-based Tier was still at the tip of conference-goers tongues, but there was also plenty of talk about how companies aren’t necessarily buying each other up – but rather sprucing up their offerings by joining forces.

For example, Metro Mobility is working with Segway to develop new charging stations. The proposed ChargeLock station features a patent-pending cable design to incorporate charging and locking in a single connector, providing a simple and reliable station at a fraction of the cost. Drover AI and Luna Systems are also two startups collaborating with Segway to offer an integrated AI solution in scooters. Rather than retrofitting third-party hardware and software systems onto Segway vehicles, shared micromobility operators can now have a unified platform that includes everything from the scooter itself to intelligent sensors to computer vision models. Expect to see more integrations that allow AI to reshape the scooter experience, especially as it relates to safety and security.

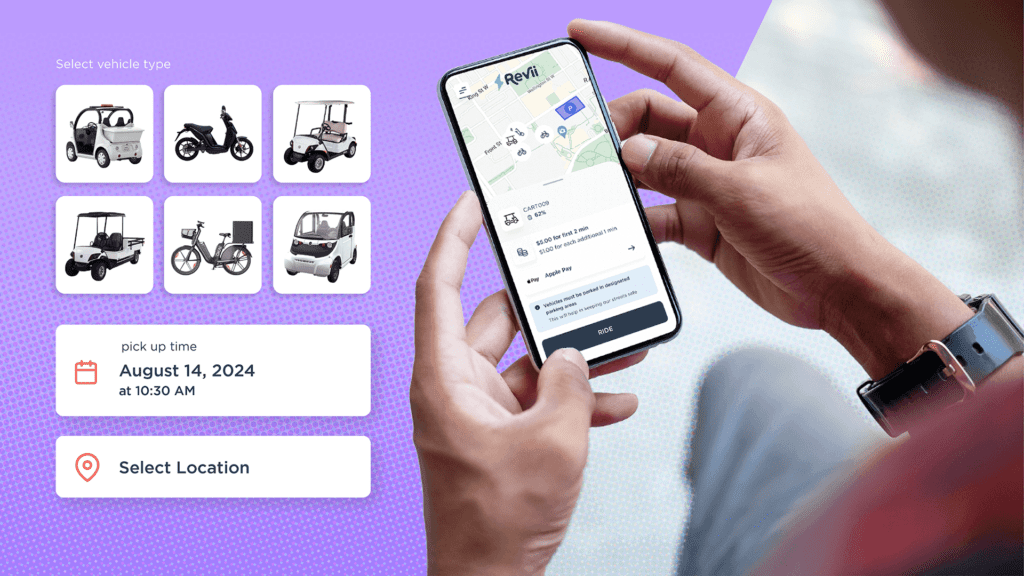

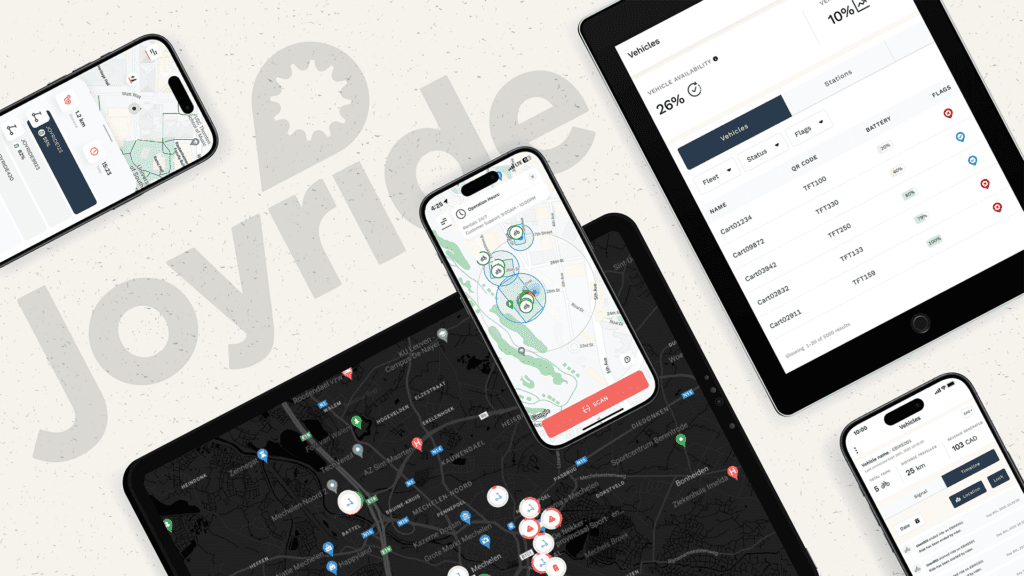

From an operator’s perspective, the offerings of tools are growing quickly. For example, Joyride’s SaaS offering continues to expand with Open API capability and third-party tools – such as Mavenoid for customer support – that are designed to keep fleet owners in motion using one platform, rather than fragmented add-ons that decrease operational efficiency.

We’re firm believers that partnerships and acquisitions are natural market needs in order for the industry to mature, and these notions were upheld during the course of the conference.

3. The dialog is shifting from fast growth to long-term sustainability

Even with a diverse lineup of conference panellists and sessions, it was possible to narrow down some standout conversation themes. There’s a clear shift in industry messaging occurring: from emphasizing scale and growth to the benefits of long-term profitability and sustainability.

Gone are the days of burning through capital and deployments. As the shared mobility industry reaches a new era of maturity, the focus has redirected to how operators can turn profits – and not just the heads of Silicon Valley VCs.

This shift bodes well for medium-sized operators who are steadily growing their fleets in mid-sized markets, many of which were left vacated by larger players like Bird and Lime. We’re continuing to see our global roster of customers expand in regions with sustainable business models and profitable returns – thanks to low operational overhead, automated tools, effective relationships with stakeholders and community engagement.

What about sustainability as it relates to the environment? Business stability is one thing, but there’s more emphasis than ever on the environmental impact of micromobility as a long-term solution to climate change. If Micromobility Europe is a microcosm for change, consider the fact that huge corporations were in attendance and are increasingly seeking small vehicles to drive big improvements to their global footprints.

Walmart, for example, is looking at promoting more employee cycle programs. Expect to see more cycling incentive programs pop up at companies, which present large opportunities for operators large and small to expand their business and environmental mandates at the same time.

Speaking of time, we’re already looking ahead to Micromobility America in San Francisco this fall. With the summer season upon us, we’re also looking forward to seeing these industry trends take shape both on the ground and in the cloud.