Summer is the best season for vehicle sharing. Ridership rises with the temperature, and we’re seeing some scorching headlines for micromobility.

Fluctuo’s latest European Shared Mobility Index forecasted 2022 as a industry-defining year, and a recent report from UC Berkeley predicts that mobility services, including ride hailing and bike-sharing, are expected to generate annual revenue of $660 billion in 2030.

The news isn’t all sunny though.

Micromobility startups did not escape unscathed from a June whirlwind of tech layoffs, and despite a hybrid home and office work schedule, North American car trips are back to pre-pandemic levels.

Consumer expectations are shifting and the competition is fierce. So how are entrepreneurs hanging on to this wild ride? This very question was answered in-depth during last month’s Joyride Academy Experience at Micromobility Europe. And we’re bringing you a recap—plus more than two hours of premium video content from the event—here today.

Owning small and mid-sized markets

Lately, the industry big guns are turning their operational focus to small metropolitan service areas. Why? Because being local-first is one of the main reasons independent shared-mobility brands are thriving. Profitability isn’t guaranteed in a smaller market, but the strategy to “first do it well, then do it bigger” has proven to be effective.

And small business doesn’t mean small potatoes.

During our ‘Global Mobility Panel’ at the Micromobility Europe Joyride Academy Experience, Sean flood of EFO Ventures (and former co-founder of US operator Gotcha) noted, “The future [of micromobility] will still have big operators, but there is a sense of importance for localness. As hardware and technology become more readily available, you have operators at a local level who are creating individual businesses and they are able to focus on profitability.”

Trond Frost of Bullride.com added: “It’s good to be able to run local operations, and I actually do believe this is the solution…but in my world this could mean from 50 bikes, to five or six hundred.”

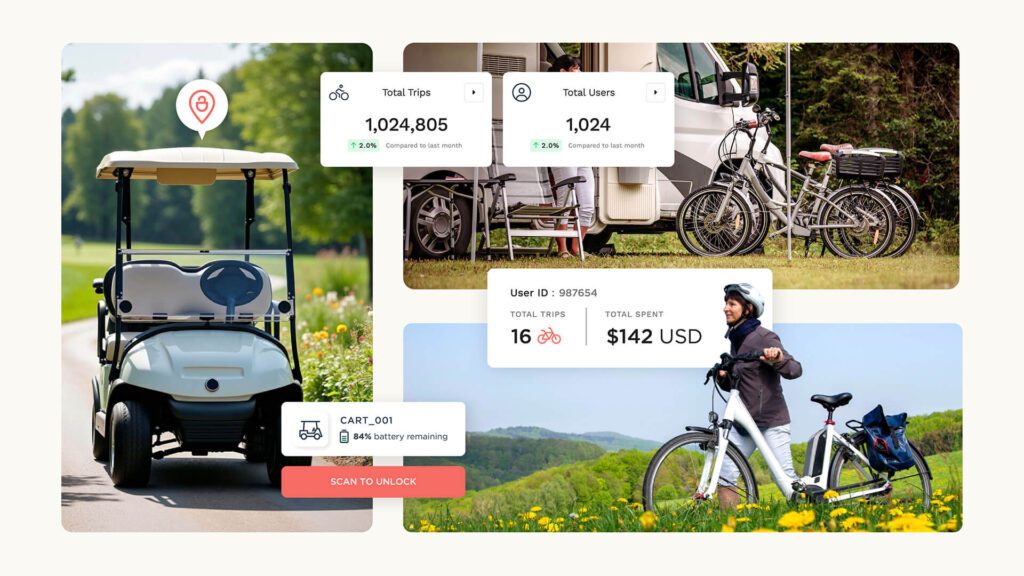

Fortunately, the Joyride platform enables both ends of the spectrum.

Many self-identified ‘small businesses’ are running enterprise-sized fleets in multiple markets. These operators reached profitability early on because they focused on a sustainable growth strategy and scaled from that initial success. Creative financing options like fleet leasing with Bullride.com as well as a local-first values shift means more local players are able to enter, and stay on stage.

Turning operator experience into vehicle excellence

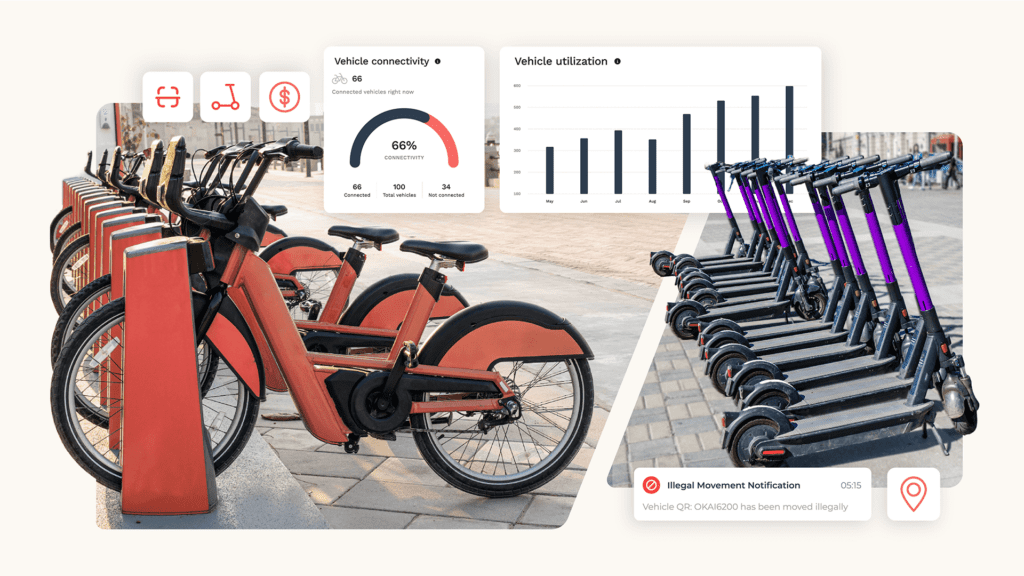

Shared mobility is at the crossroads of hardware, software and customer experience – the lynchpin of industry innovation. Using feedback from fleet operators, scooter and e-bike manufacturers have iterated their products into longer-lasting, safer and smarter devices.

Currently in their fourth or fifth generation, these vehicles are good, really good, but nobody knows shared mobility vehicles better than the folks who deploy them at dawn and fix them throughout the day.

Enter a new age of operators-turned-manufacturers.

Also during our Global Mobility Panel, Sean Flood referenced hardware struggles associated with the early days of electric vehicle sharing. Despite being operators, he said, “we spent so much time developing the product.”

Fleet owners quickly become familiar with the faulty points of their devices, but around the world some operators are fighting to get any hardware at all. Flood added, “especially as supply chain issues came about, every operator I talked to, big and small, didn’t like the product they were getting or couldn’t get the one they wanted.”

The team at Element (an EFO Ventures portfolio company) used these insights to develop the Core+ e-bike and Gravity scooter, which use the same swappable battery – one of many features designed to address the real pain points of shared mobility operators. Fully integrated with sophisticated software and available amidst supply chain blockage, it’s easy to see why they’re seeing success.

And they aren’t the only ones.

Kristjan Maruste of Aike (Comodule’s sister vehicle manufacturer) shared how operating shared fleets in Estonia and Latvia influenced the development of their Co-Scooter (the first kick-scooter developed and assembled outside China) and the new Aike11.

According to Maruste, “We build the scooter, put them out into our own city…They are circulating, people are testing them and in the evening [we] can bring them back in and see what happened to them. You basically take the hardware development iteration level to the same level as software.”

Tried and tested in all weather conditions – from Nordic winters to blow up swimming pools Aike is on the growing list hardware solutions built not just for but by shared-mobility operators. Maruste added “The knowledge you get from being a small operator and designer and producing a product makes it a full circle.”

Moving cities forward with collaboration and competition

We like that the micromobility economy is circular. It makes for great wheel puns, and in a few short years the industry has grown into a thriving global ecosystem.

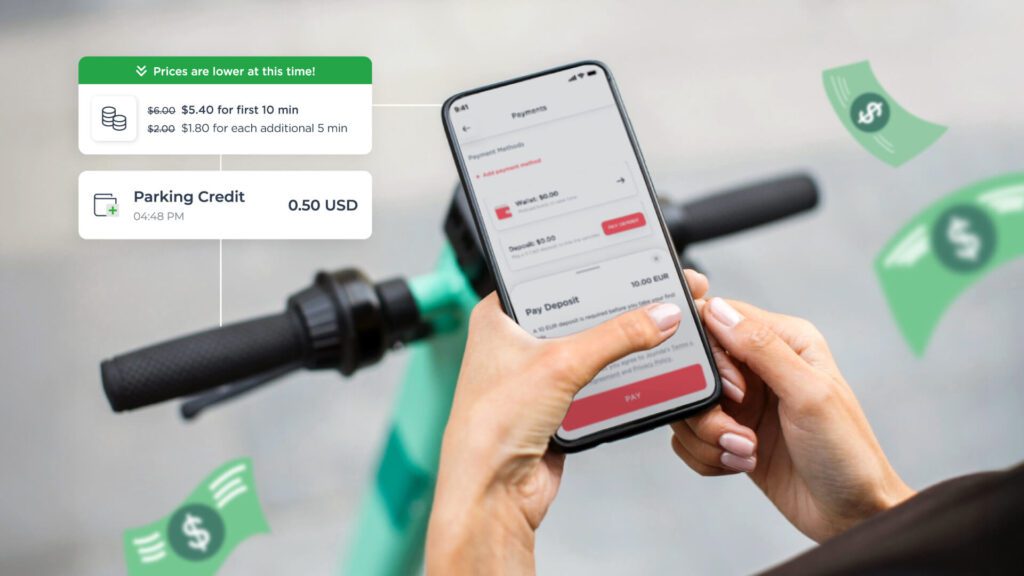

Of course, at the end of the day, operators and investors alike are in the business of making money. Panelist Trond Frost of Bullride.com said, “Everybody in the chain has to make a profit. If not, it’s not going to be successful.” and we agree.

It’s this competition and collaboration fueling rapid growth and innovation in the micromobility industry.

Where will you take it? We’d love to find out.