As the micromobility industry continues to expand, fleet operators face the challenge of securing affordable financing options to fuel their growth. Managing and scaling a shared fleet with hundreds or thousands of vehicles requires capital investments. That’s where Joyride Financing steps in.

Joyride Financing is a program exclusively for micromobility operators that’s aimed at removing one of the biggest barriers to growth and expansion. By offering affordable and flexible financing solutions, operators gain access to the funds needed to support fleet expansion – all within three days of approval.

Who can benefit from Joyride Financing?

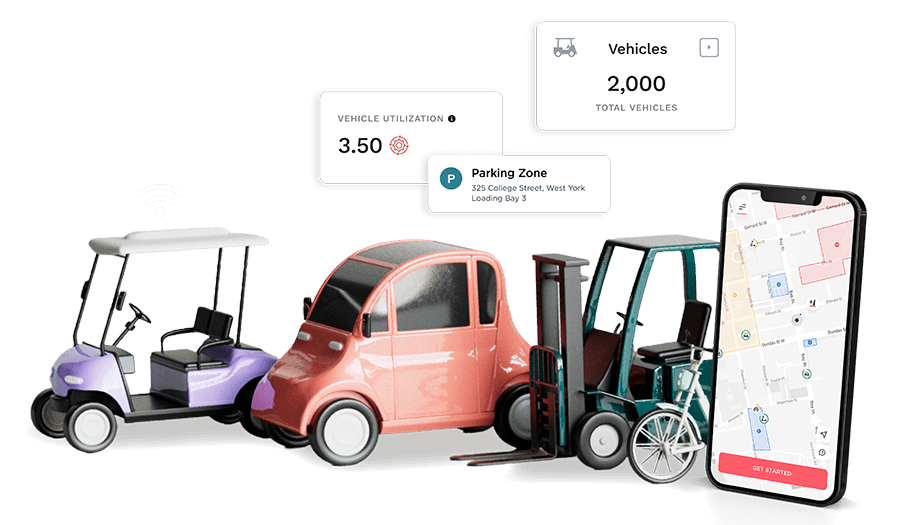

This game-changing program caters to both established micromobility operators and emerging startups. Whether you’re looking to expand your fleet operations or kickstart your business, Joyride Financing offers the required financial resources and support.

Operators of all sizes can leverage this program to overcome financial barriers and achieve success. Payment for new electric vehicles is the largest outlay an operator will make for their fleet. Consider the costs associated with upkeeping a fleet. Generally, a top-of-the-line sharing-ready scooter will cost approximately US$700 to US$800 per unit, depending on order volume. These figures are before shipping and importing fees. Keep in mind, Joyride Financing is applicable for vehicles only, including electric bikes, electric scooters and other light electric vehicles.

For a list of top industry vehicles available to purchase right now, visit Joyride Garage here.

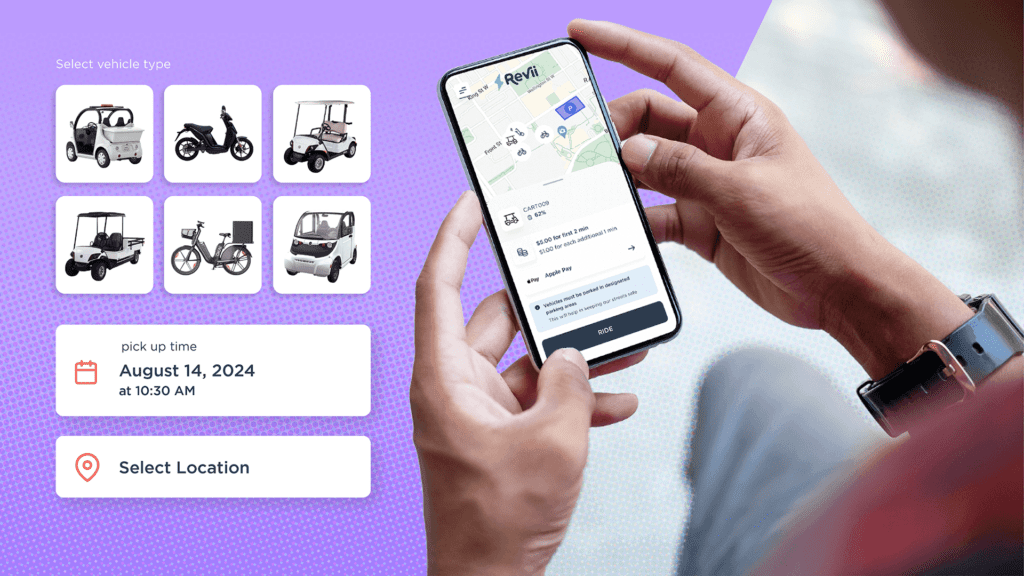

How does Joyride Financing work?

Our four-step process is designed to provide operators with a smooth experience and fast access to capital.

- Select Vehicles – Source a purchase order quote from Joyride Garage or a standalone vehicle manufacturer

- Get Pre-Qualified – To begin, fill out a simple form with basic information about your business. This will help us determine if you meet our minimum requirements for financing.

- Submit All Documentation and Formal Application – Once pre-qualified, you will be connected with a Joyride Financing partner for a full application and credit check

- Get Financed – Once approved, we will work with you to finalize the financing agreement and distribute the vehicle financing funds to the manufacturer to initiate the order. We offer flexible financing options, competitive rates and fast turnaround times.

Joyride’s financing process typically takes between one to three business days to get approved. Our team works diligently to ensure a streamlined process, so you can get your fleet up and running as quickly as possible.

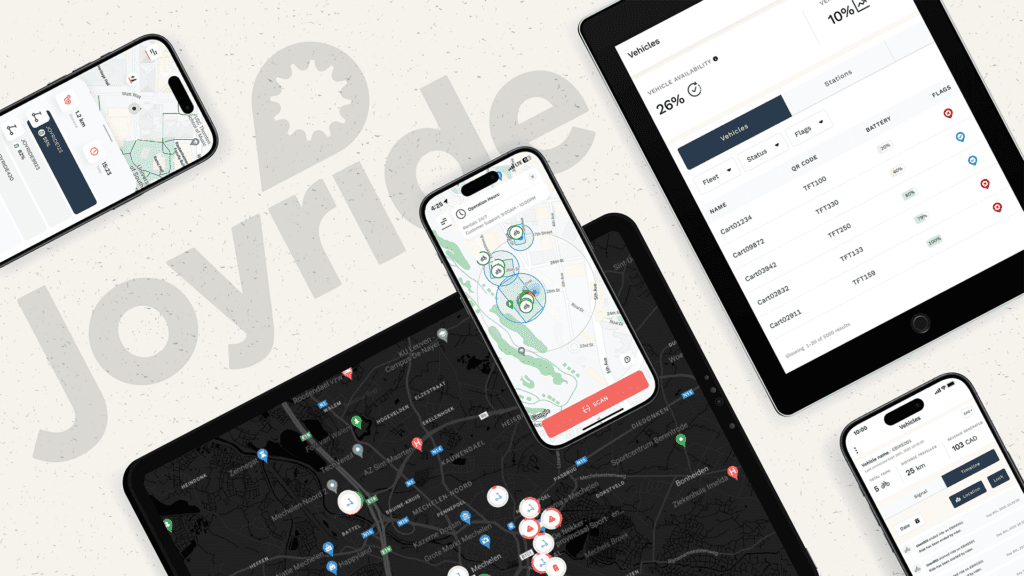

Importance for the micromobility industry:

The micromobility industry is booming, but many operators struggle to secure the necessary funds to scale their operations.

Together with our partners, we recognize that micromobility is an industry that is largely seasonal, which impacts business cash flow and thereby lending procedures. Seasonal cash flows in a new industry are not always appealing to traditional lending institutions. Therefore, many lending doors are shut before a financing conversation can even begin.

We recognize this gap, and we positively view micromobility form factors as a legitimate asset class to be capitalized on all levels of the value chain.

Additionally, the payback period for shared micromobility assets is much quicker than many other equipment financing or leasing types (e.g. construction equipment, restaurant set-ups, etc.). As such, even traditional lenders willing to entertain deals in this space don’t appreciate the proper timing of repayment terms. We do. This is why we can offer proper cash flow repayment flexibility to match the industry cycles as it relates to vehicle life time and ROI for both operators and lenders.

By offering accessible financing options, Joyride is empowering operators to invest in new vehicles and expand their services. As the go-to partner for financing, Joyride is continuing to reshape the micromobility landscape by partnering with operators to ensure their long-term growth at all stages.

Take the first step and explore Joyride Financing today, and don’t miss the opportunity to access a list of top industry vehicles available for purchase right now at Joyride Garage.