If there will be one word to describe electric vehicle transportation in 2021, it’s traction. The building momentum for electric cars will come to fruition this year, and that stickiness will stem to lightweight electric vehicles (EVs) in the form of scooters, bikes and mopeds, all of which are expected to see accelerated adoption after five years of steady growth.

Environmental, economic, political and health-related circumstances are prompting billions of dollars to pour into the micromobility industry, leaving entrepreneurs with major opportunities. Here’s the 101 on funding initiatives and tech advancements that bode well for operators with their own electric vehicle fleets to scale in 2021.

The stock market is banking on EVs

If 2020 saw a rise in the electrification of vehicles, 2021 will be when things take shape. It’s promising to view the stock market value of companies that support EVs alongside reports of commuters’ ongoing preference for micromobility vehicles over cars and public transit. Analysts are favoring companies that supply EV manufacturers or develop technology to support infrastructure and autonomous driving. On the NYSE, Nio and Acrimoto were among the fastest-growing electric vehicle stocks in 2020. With a market capitalization of $35 billion, China-based Nio manufacturers smart and connected EVs, and the company delivered a total of 5,291 vehicles in November alone, an increase of 109.3% compared to the same period a year ago. Acrimoto develops and manufactures three-wheeled electric vehicles, including one for first responders and a last-mile delivery vehicle. Meanwhile, the world of sustainable finance has surpassed one trillion dollars in issuance of green bonds. In Q3 2020, companies, financial institutions, governments and municipalities raised more than $215 billion dollars in green bonds, which is 15 times more than raised in all of 2013.

It’s not just electric cars that are leading the way. Last year, a BloombergNEF analysis found that the electric vehicles currently on the road are already avoiding a million barrels per day of the world’s would-be oil consumption. And micromobility vehicles are the ones making the largest impact. Two- or three-wheelers have been responsible for more than half of that decreased demand for oil. There are almost 250 million small electric vehicles on the road today. While China buys more than 18 million electric two-wheelers a year, Bloomberg expects the world to buy 70 million by 2040.

The UK and US are seeing green

The UK government recently announced that all sales of diesel and petrol-fueled cars and vans will be banned after 2030 (moving up the original 2040 earmarked cutoff by a decade). Plus, about £582 million will be provided to help people afford zero- or ultra-low emission vehicles. With the UK heavily investing in cleaner transport, the U.S. is poised to follow. Under President Joe Biden’s platform for sustainable infrastructure, his administration will help cities “invest in infrastructure for pedestrians, cyclists and riders of e-scooters and other micromobility vehicles.” The platform calls for $2 trillion in investment for infrastructure and clean energy in order to achieve net-zero emissions on the power grid by 2035 and economy-wide by 2050. Among the areas focused on transportation, anticipated changes include the plan to “position America to be the global leader in the manufacture of electric vehicles and their input materials and parts.”

Last month, former Democratic presidential candidate Pete Buttigieg was appointed the next Secretary of Transportation, where he will oversee electric charging infrastructure as the government makes a serious push into clean energy investments. Per Politico, the US Energy Department will tap into a $40-billion fund to help slash emissions from the transportation sector, which is the largest contributor to climate change. “Electrifying the nation’s fleet of vehicles would represent one of the most seismic market and technological upheavals in recent history,” the article states.

Multiple dollars for multimodal vehicle systems in Europe

E-bike sharing in Europe will particularly hit its stride this year. In Finland, for example, the country is already experiencing exponential growth in e-bike sales, which are expected to continue through 2021. During the government’s budget debates in the Autumn, it was announced that people who purchase bicycles for work commutes would be able to deduct up to €1,200 on their annual income taxes. Finnish employers can also deduct the cost of the bike from workers’ salaries or offer the compensation in the form of an increase in pay, without extra costs. The tax break will lead e-bike leasing agreements to increase significantly.

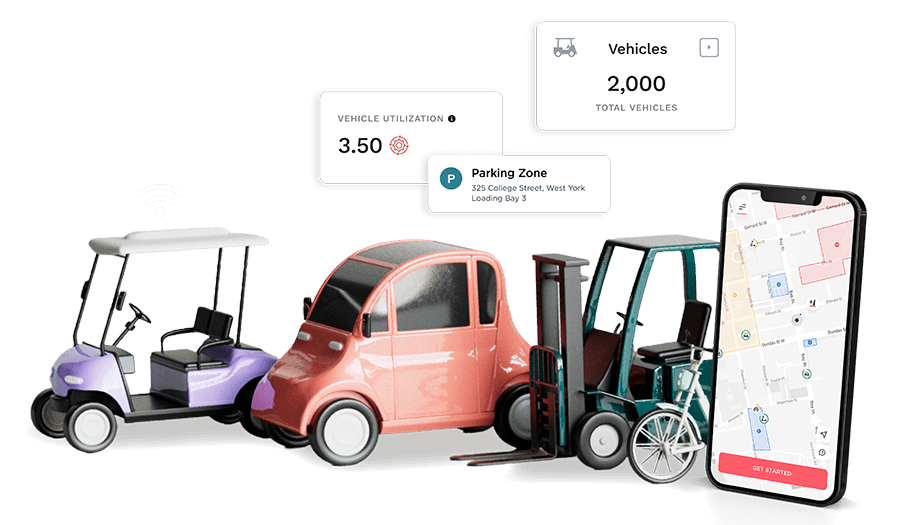

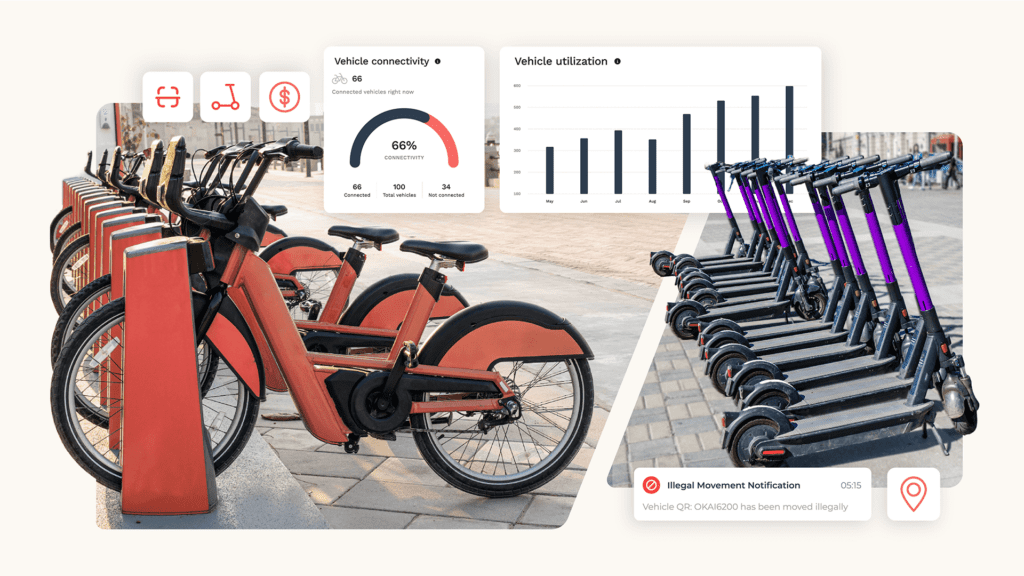

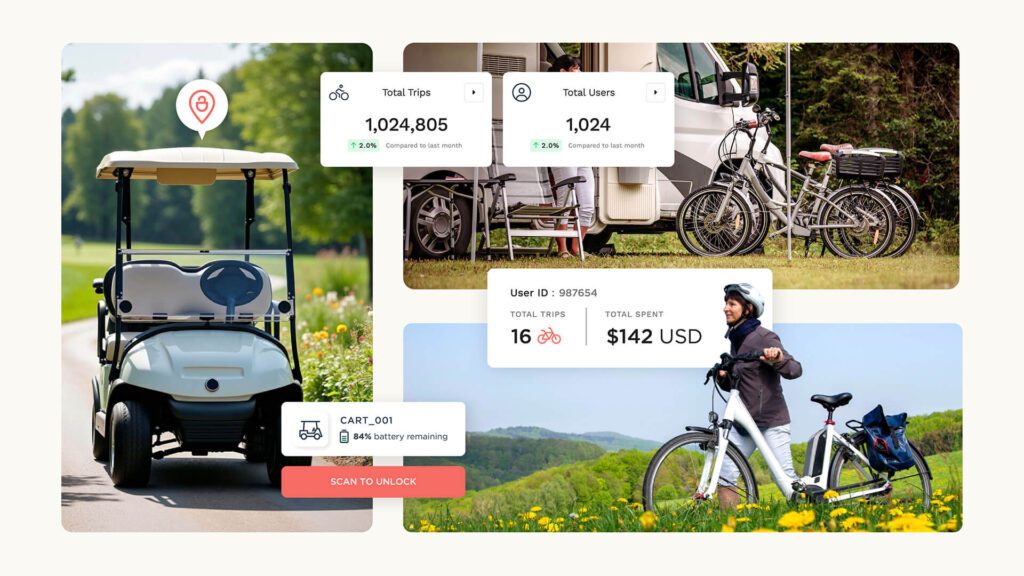

Overall, Europe will be a hotbed for lightweight EV growth. The continent had the largest fall in internal combustion sales in 2020 (down almost 56% year on year) and a similarly massive increase in EV sales (up more than 45%), according to Bloomberg. Already in European cities like Paris we are seeing more scooter-sharing operators expanding their offerings to include e-bike sharing, creating full multimodal systems that operate on one single software platform. With Joyride software able to support toggling between multiple micromobility vehicles, our operators are able to adopt a mixed array of hardware without disrupting the experience of the end user. And with momentum for docking solutions on the rise, municipal funding will continue to prioritize micromobility transportation options as a safe alternative to public transit and cars.

How to roll with it

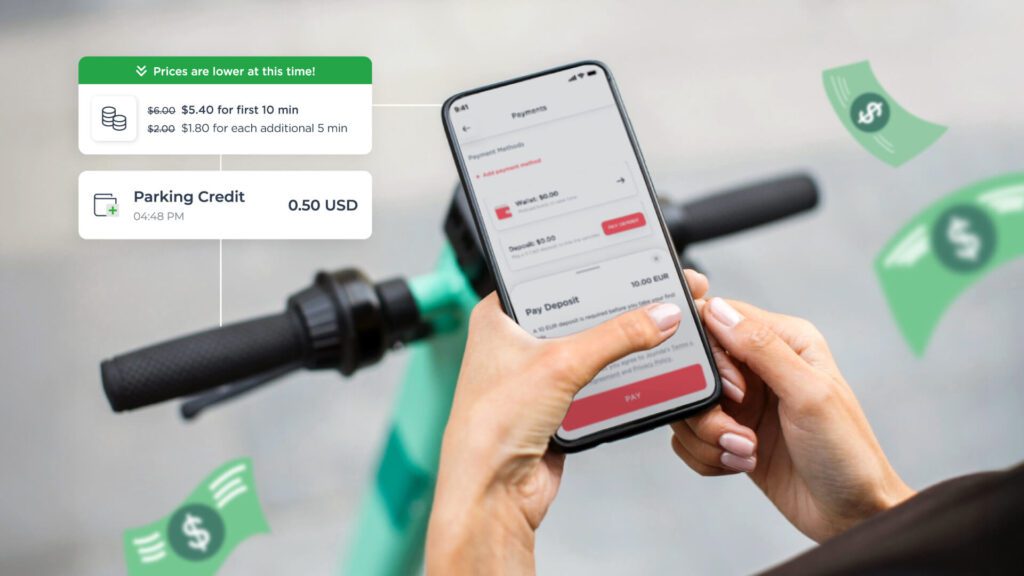

It’s clear a worldwide movement toward sustainable transportation is going to kick into high gear this year, with micromobility playing a large role. Scooter-sharing businesses are likely to recover their upfront costs in a matter of months based on 30% profit margins, meaning the revenue potential for even small- to mid-sized fleets is substantial.

To find out more about the simplicity of scaling a shared mobility system, either under a B2B or B2C model, contact our sales team today to discuss your best options.