This month marked the return of Joyride to Micromobility Europe, an annual conference dedicated to charting the current state – and future – of the shared mobility industry.

As long-time supporters of this conference, we’ve witnessed the industry’s evolution firsthand, from cutting-edge hardware to robust business strategies.

This year was no exception, with plenty of conversations, panels and vehicle test rides highlighting the rapid technological advancements and the bright future of shared micromobility.

Here are three key trends we observed, along with our predictions and actionable insights for mobility operators and investors.

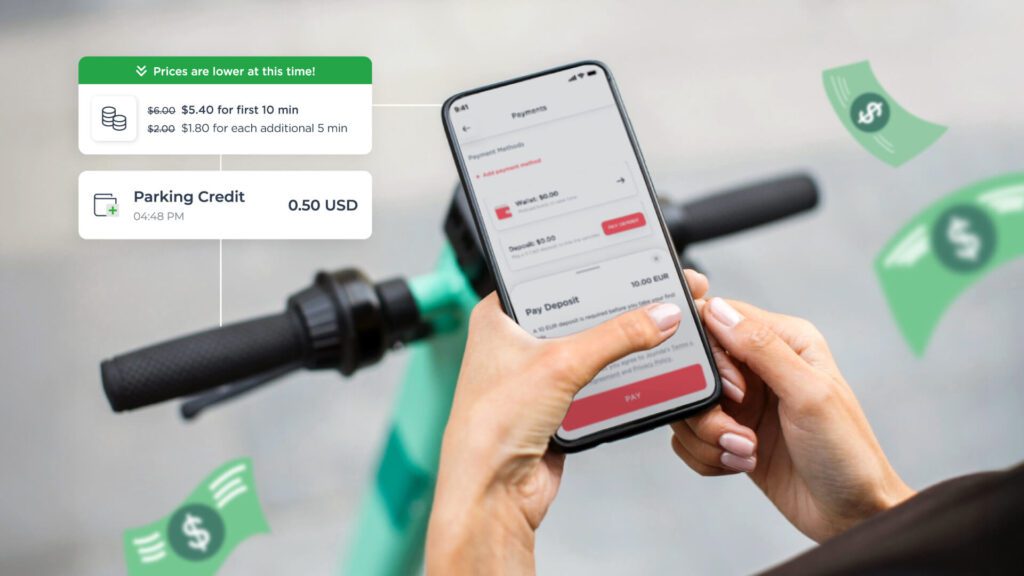

1. Clear path to profitability: redistributing funds and micromobility market share

The micromobility industry is entering a phase where profitability is not just a goal but a tangible reality. Companies like Tier-Dott, Swing and Lime are leading the charge, with Spin (recently acquired by Bird) achieving consecutive profits–and Bird itself on track to black.

This was clearly outlined in one conference session panel entitled “How to build a profitable company in shared micromobility?” Featuring executives from Tier-Dott, Segway-Ninebot, Ryde Technology and Swing, topics mainly circulated around R&D expenditures and operational cost control measures – as well as the reduction of vehicle theft and vandalism, which is translating to lower overhead costs for operators. In fact, according to Segway, the true longevity of shared scooters has increased to five years.

What does that mean for independent operators? The flashy venture capital funds spending days are over, pushing companies to adopt leaner, higher-margin models, ultimately leading to more consolidated growth.

This redistribution of funds has forced a market correction, where operational efficiency and cost control are prioritized, setting the stage for continued growth and profitability.

Prediction: The trend towards profitability will continue, with companies focusing on efficient resource allocation and strategic growth. As ridership soars, we expect to see more acquisitions, and a handful of new players reaching profitability and sustained growth in the coming years.

2. Cost control in manufacturing: reducing supply chain and maintenance costs

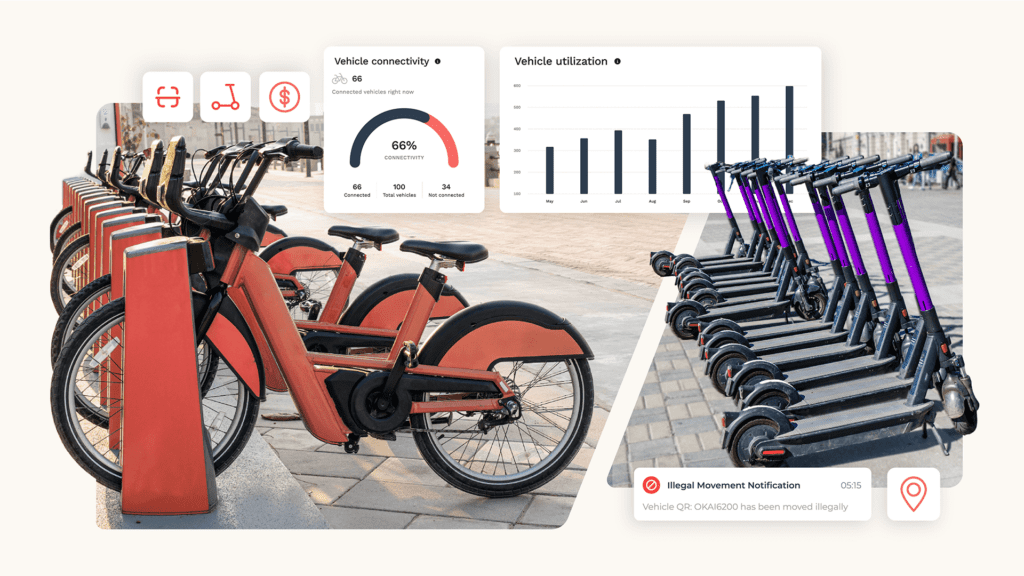

Keeping costs low is not limited to shared mobility operations but extends to the manufacturing sector as well. After years of product development and iteration, shared micromobility vehicles are high-quality smart machines, built to last for many operating seasons.

With such robust vehicles as the industry standard, Original Equipment Manufacturers (OEMs) must explore new ways to capture market share in the B2B fleet sales sector.

At this year’s conference, Okai and Navee introduced lower-cost sharing scooters with steel frames (previously built with more costly aluminium-alloy). Similarly, Segway’s newest scooter models come with extended warranties aimed at lowering vehicle maintenance costs while providing additional reliability for fleet operators. This ends up being a win-win for everyone.

Prediction: Despite supply chain challenges within the micromobility industry, we anticipate more affordable and robust electric vehicles entering the market, lowering the barriers to entry and supporting further fleet expansion.

3. Proliferation of AI cameras: enhancing vehicle safety and efficiency

Innovations in battery technology, IoT devices and autonomous vehicle capabilities were other hot topics of conversation. These advancements are expected to drive the next wave of innovation in the micromobility industry – and especially across multiple and new form factors.

AI cameras in particular were a prevalent theme across various booths at the conference. Companies like Luna and Omni showcased advanced camera systems capable of sidewalk and people detection, sending real-time signals to riders and fleet management systems.

Prediction: The adoption of AI cameras and other smart technologies will become standard in the industry. These advancements, strongly favored by city officials in the public tender process, are intended to improve rider safety, reduce accidents and optimize fleet management.

Welcoming the next wave of innovation

Micromobility Europe 2024 provided a glimpse into a dynamic future for the micromobility industry. The development of more intelligent, connected and autonomous vehicles continues to positively enhance user experiences and create new operational efficiencies.

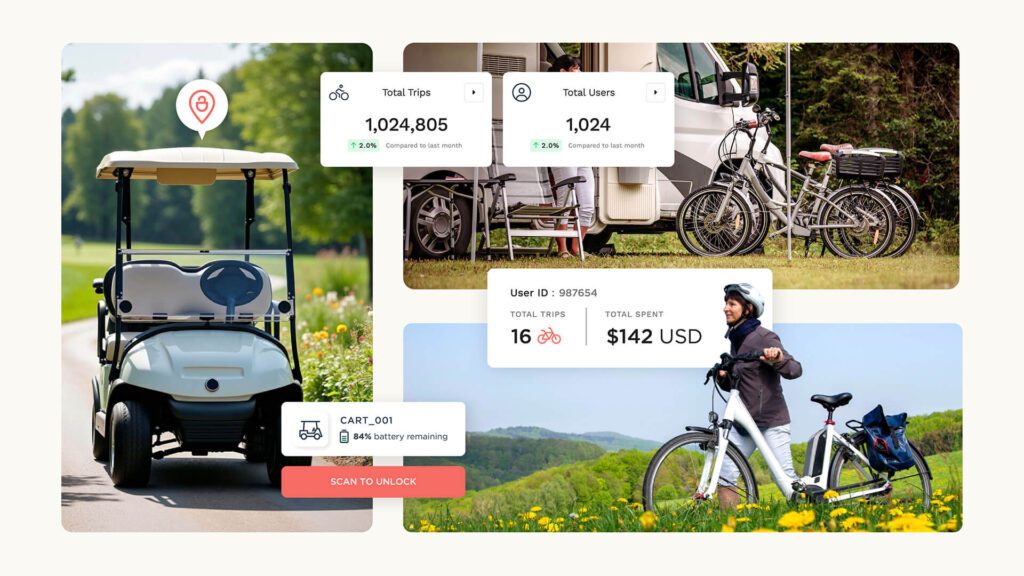

As a leading mobility SaaS platform, Joyride is poised to leverage these trends and technologies to continue transforming mobility models and modernizing industries with sustainable connected vehicle solutions.

Gearing up to launch a vehicle sharing business?

Joyride has all the information you need to navigate the micromobility landscape–from shaping your business strategy with Joyride Academy, to sourcing fleet vehicles through Joyride Garage.

Contact us to bring your shared mobility vision to life, today.